Medicare Information

The Parts of Medicare

Social Security enrolls you in Original Medicare (Part A and Part B).

• Medicare Part A (hospital insurance) helps pay for inpatient care in a hospital

or limited time at a skilled nursing facility (following a hospital stay). Part A also pays for some home health care and hospice care.

• Medicare Part B (medical insurance) helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

Other parts of Medicare are run by private insurance companies that follow rules set by Medicare.

- Supplemental (Medigap) policies help pay Medicare out-of-pocket copayments, coinsurance, and deductible expenses.

- Medicare Advantage Plan (previously known as Part C) includes all benefits and services covered under Part A and Part B — prescription drugs and additional benefits such as vision, hearing, and dental — bundled together in one plan.

- Medicare Part D (Medicare prescription drug coverage) helps cover the cost of prescription drugs.

Most people age 65 or older are eligible for free Medical hospital insurance (Part A) if they have worked and paid Medicare taxes long enough. You can enroll in Medicare medical insurance (Part B) by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium. To learn more, read Medicare Premiums: Rules For Higher-Income Beneficiaries.

Should I Sign up for Medical Insurance? (Part B)

With our online application, you can sign up for Medicare Part A (hospital insurance) and Part B (medical insurance). Because you must pay a premium for Part B coverage, you can turn it down.

If you’re eligible at age 65, your initial enrollment period begins three months before your 65th birthday, includes the month you turn age 65, and ends three months after that birthday.

If you choose not to enroll in Medicare Part B and then decide to do so later, your coverage could be delayed and you may have to pay a higher monthly premium for as long as you have Part B. Your monthly premium will go up 10 percent for each 12- month period you were eligible for Part B, but didn’t sign up for it, unless you qualify for a “Special Enrollment Period” (SEP).

If you don’t enroll in Medicare Part B during your initial enrollment period, you have another chance each year to sign up during a “general enrollment period” from January 1 through March 31. Your coverage begins on July 1 of the year you enroll. Read our Medicare publication for more information.

If you have a Health Savings Account (HSA) or health insurance based on current employment, you may want to ask your personnel office or insurance company how signing up for Medicare will affect you.

Special Enrollment Period (SEP)

If you have medical insurance coverage under a group health plan based on your or your spouse’s current employment, you may not need to apply for Medicare Part B at age 65. You may qualify for a “Special Enrollment Period” (SEP) that will let you sign up for Part B during:

-

Any month you remain covered under the group health plan and you or your spouse’s employment continues.

-

The 8-month period that begins with the month after your group health plan coverage or the employment it is based on ends, whichever comes first.

How to apply online for just Medicare

If you are within three months of turning age 65 or older and not ready to start your

monthly Social Security benefits yet, you can use our online retirement application to

sign up just for Medicare and wait to apply for your retirement or spouses benefits

later. It takes less than 10 minutes, and there are no forms to sign and usually no

documentation is required.

Already Enrolled In Medicare?

If you are enrolled in Medicare Part A and you want to enroll in Part B, please complete form CMS-40B, Application for Enrollment in Medicare – Part B (medical insurance). If you are applying for Medicare Part B due to a loss of employment or group health coverage, you will also need to complete form CMS-L564, Request for Employment Information.

You can use one of the following options to submit your enrollment request under the Special Enrollment Period:

1. Goto“ApplyOnlineforMedicarePartBDuringaSpecialEnrollmentPeriod”and complete CMS-40B and CMS-L564. Then upload your evidence of Group Health Plan or Large Group Health Plan.

2. FaxormailyourCMS-40B,CMS-L564,andsecondaryevidencetoyourlocal Social Security office (see list of secondary evidence below).

Note: When completing the forms CMS-40B and CMS-L564

-

State “I want Part B coverage to begin (MM/YY)” in the remarks section of the CMS-40B form or online application.

-

If possible, your employer should complete Section B.

-

If your employer is unable to complete Section B, please complete that portion

as best as you can on behalf of your employer without your employer’s signature and submit one of the following forms of secondary evidence:

o o o o o o

Income tax form that shows health insurance premiums paid. W-2s reflecting pre-tax medical contributions.

Pay stubs that reflect health insurance premium deductions. Health insurance cards with a policy effective date. Explanations of benefits paid by the GHP or LGHP.

Statements or receipts that reflect payment of health insurance premiums.

You’ll have

can decide

that Original Medicare doesn’t cover. You can choose to join a Medicare Advantage Plan (Part C) and get all your Medicare coverage (including drugs and extra benefits like vision, hearing, dental, and more) bundled together in one plan.

Original Medicare (Part A and Part B) unless you make another choice. You to add a drug plan (Part D) or buy a Medigap policy to help pay for costs

Some people with limited resources and income may also be able to get Extra Help to pay for Part D drug costs.

What Happens After I Apply?

The Centers for Medicare & Medicaid Services (CMS) manages Medicare. After you are enrolled, they will send you a Welcome to Medicare packet in the mail with your Medicare card. You will also receive the Medicare & You handbook, with important information about your Medicare coverage choices.

Medicare Parts A and B

Medicare Part A: Hospital Insurance

Medicare, Part A, for most people, is called hospital insurance. This is because it can pay for care while you are admitted as an inpatient in a hospital. It can also pay some costs outside of the hospital as well, like skilled nursing care facilities, home health care, and hospice.

Part A Premium:

Most Medicare beneficiaries do not owe a monthly premium for Medicare Part A because they or their spouse paid it while working (FICA deduction from a paycheck), which most people call a “premium–free Part A”. Beneficiaries with premium-free Part A worked and contributed to the Part A Trust fund a minimum of 40 working quarters, or credits (about 10 years.

Beneficiaries that did not work enough credits can buy Part A, often called “Premium Part A”. In 2022, those with Premium Part A owe either the full premium or a prorated amount (between $274 and $499 a month).

IMPORTANT: Medicare beneficiaries with limited income and resources may be eligible for the Qualified Medicare Beneficiary program, one of the Medicare Savings Programs. QMB pays the Part A premium in addition to the cost-sharing and Part B premium.

Part A Deductible:

The deductible is and amount paid before Medicare begins to pay its share. The Part A deductible for an inpatient hospital stay is $1556 in 2022. The Part A deductible is not an annual deductible but applies or each benefit period. A benefit period begins at hospital admission and ends when the beneficiary has been out of the hospital or skilled nursing facility (SNF) for 60 consecutive days. As such, a beneficiary may have multiple benefit periods requiring payment of the Part A deductible multiple times a year.

Hospital Copayment/Skilled Nursing Facility Copayment:

A copayment applies to long hospital stays (60 days or more) and to skilled nursing facility stays (after a three night, Medicare covered inpatient hospital stay). The copayment amounts vary based on the length and location of the stay.

Hospice Care:

There Is no deductible or copayment for hospice care, only minimal costs for medications and inpatient respite care.

Home Health Care:

There is no deductible or copayment for home health care, if the beneficiary meets the eligibility criteria for coverage

Medicare Part B: Part B Premium:

In 2022, most beneficiaries will pay $170.10 a month for Part B, but there are two instances where beneficiaries may pay more or less than this amount.

Beneficiaries subject to “hold harmless” provision whose Social Security checks will not increase enough to cover the $170.10 premium:

The hold harmless provision in federal law protects Medicare beneficiaries in two ways:

Part B premiums cannot increase in years when there is not Social Security and cost of living adjustment (COLA), and the net social security benefit cannot be lower than the previous year’s benefit amount.

In 2021, the Social Security COLA was 1.3%. In 2022, the COLA will be 5.9%. For a small percentage of hold harmless beneficiaries with low Social Security benefit amounts, this means that while their Part B premium will increase in 2022, it will not reach $170.10, since their benefit cannot decrease.

Beneficiaries with higher incomes:

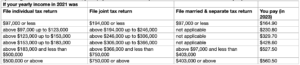

Certain individuals pay more for their Part B premiums because they are subject to income-related monthly adjustment amounts, or IRMAA, rules. IRMAA applies to individuals whose modified adjusted gross income on their 2020 tax returns was more than $91,000 per individual or $182,000 for a couple.

Other Costs in Part B:

In addition to the Part B premium, there are out of pocket. Costs beneficiaries pay when they receive services covered by Medicare Part B. And these costs, like the Part B premium, may change each year.

Part B Annual Deductible:

Before Medicare starts covering the costs of care, people with Medicare pay an amount called a deductible. In 2022, the Part B deductible is $233.

After the deductible has been paid, Medicare pays most, typically 80% of the approved costs of care for services under Part B while people with Medicare pay the remaining cost, generally 20%, for services such as doctor visits, outpatient therapy, and durable medical equipment, (wheelchairs, hospital beds, home oxygen equipment, diabetes supplies).

Medicare has strict rules on what durable medical equipment, prosthetics, orthotics, and supplies (DMEPOS) are covered. It is important to understand Medicare’s “reasonable or medically necessary” rule or beneficiaries could ultimately pay more for DMEPOS. Medicare, thankfully, has an approved list of DMEPOS suppliers.

Preventive Benefits:

There are some services under Part B that Medicare covers at 100%, like certain preventive benefits. These services can be explored at medicare.gov

Medicare Part B (Medical Insurance) Costs (continued)

If your modified adjusted gross income as reported on your IRS tax return from

2 years ago is above a certain amount, you’ll pay the standard Part B premium and an income-related monthly adjustment amount.

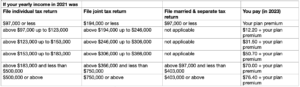

Part D monthly premium

The chart below shows your estimated drug plan monthly premium based on your income. If your income is above a certain limit, you’ll pay an income-related monthly adjustment amount in addition to your plan premium.

Medicare-Covered Preventive Services

If you have Original Medicare, you pay no coinsurance or deductible for certain preventive services if you see a doctor who participates in Medicare. Medicare Advantage Plans must also cover the full cost for these services if you follow the plans rules. Call your plan for details.

You might have cost for some of these preventive services if your doctor makes a diagnosis during the service or does additional tests or procedures. For example, if your doctor removes a polyp during a colonoscopy, the colonoscopy will be considered diagnostic, and costs may apply.

Services Original Medicare covers without a deductible or coinsurance*

Abdominal Aortic Aneurism (AAA) –

Once in a lifetime ultrasound screening if you are at risk for AAA and receive a referral from your provider.

Alcohol misuse screening and counseling –

An annual screening, and up to four brief counseling sessions every year if your provider determines that you are misusing alcohol. You do not need to show signs or symptoms of alcohol abuse to qualify for screening.

Annual Wellness Visit (AWV) –

An annual appointment with your primary care provider (PCP) to create or update a personalized prevention plan. This plan may help prevent illness based on your current health and risk factors. Not a head-to-toe physical. You cannot receive your AWV within the same year as your welcome to Medicare preventive visit.

Breast Cancer Screening –

An annual mammogram screening for women 40+ and one baseline mammogram for women ages 35-39.

A breast examination once every 24 months for all women. You may be eligible for an exam every 12 months if Medicare considers you at risk.

Cervical Cancer Screenings –

A pap smear and pelvic examination once every 24 months for all women. You may be eligible for an exam every 12 months if Medicare considers you at risk.

Colorectal Cancer Screenings –

Fecal occult blood test: once every 12 months if you are age 50+. Colonoscopy: once every 24 months if Medicare considers you at high risk.

Flexible sigmoidoscopy: once every 48 months if you are age 50+ and Medicare considers you at high risk.

Depression Screenings –

An annual screening in a primary care setting. You do not need to show signs or symptoms of depression to qualify for screening.

Diabetes Screening –

An annual screening, including a fasting blood glucose test and/or a post-glucose challenge test, if Medicare considers you at risk.

HIV Screening –

An annual screening for anyone age 15-65, or younger than 15 years or older than 65, and at an increased risk.

Heart disease screening –

Blood tests for heart disease once every five years, when ordered by your provider. An annual cardiovascular disease risk reduction visits with your PCP.

Hepatitis C Screening –

One screening if your test PCP orders the test for you:

-

Were born between 1945 and 1965

-

Had a blood transfusion before 1992

-

Or, are considered high risk due to current or past history using federally prohibited,

injectable substances

If Medicare considers you at high risk, you also qualify for yearly screenings following the initial screening.

Lung Cancer Screening –

An annual screening and Low-Dose Computed Tomography (LDCT, also called Low-dose CT) chest scan.

Medicinal nutritional therapy (MNT) –

Three hours of therapy for the first year and two hours for every subsequent year if you get a referral from your PCP, see a registered dietician or other qualified nutrition specialist, and have one of the following conditions:

• Diabetes

-

Chronic Renal Disease

-

Or, have had a kidney transplant in the past 3 years.

Behavioral Counseling –

Body mass index (BMI) screenings and behavioral counseling to help you lose weight if you are obese. You are obese if you have a BMI of 30 or higher.

Bone Mass Measurements –

Measurement once every 24 months if you are at risk for osteoporosis. Medicare will also cover follow-up measurements and/or more frequent screening if your doctor prescribes them.

Prostate Cancer Screenings –

An annual screening for all men ages 50+. This screening includes a digital rectal exam (DRE) and a prostate-specific antigen (PSA) test.

Sexually transmitted interaction (STI) screenings –

Screening tests for chlamydia, gonorrhea, syphilis, and/or hepatitis B if you are at a high or increased risk of contracting an STI or pregnant. Screenings are covered annually if you receive a referral from your PCP or at certain times during pregnancy.

Smoking Cessation Counseling –

Two smoking cessation counseling attempts each year if you use tobacco. Each counseling attempt includes up to four face-to-face sessions with your provider, for a total of up to eight sessions.

Vaccinations –

Influenza (flu) shots: one flu shot every flu season.

Pneumococcal (pneumonia) shots: first shot if you have never received Part B coverage for a pneumonia shot before. A different, second vaccination 12 months after receiving the first shot.

Hepatitis B shots: Vaccination if you are at medium or high risk.

Welcome to Medicare Visit –

One-time appointment you can choose to receive when you are new to Medicare. The aim of the visit is to promote general health and help prevent diseases. Note that you must receive this visit within the first 12 months of your Part B enrollment.

Services Original Medicare covers with a deductible or coinsurance*

Original Medicare covers the following services at 80% of the Medicare-approved amount. If you receive the service from a participating provider, you pay a 20% coinsurance after you meet your Part B deductible.

Colorectal Cancer Screenings –

Barium enema: Once every 24 months if you are age 50+ and Medicare considers you at high risk.

Diabetes Self-Management Training –

Up to ten hours during the first year you receive training. After your first year, Medicare covers up to two hours of additional training annually.

Glaucoma Screenings –

An annual screening if Medicare considers you at high risk. The screening must be performed or supervised by an eye doctor who is licensed to provide this service in your state.

* Although this information is a comprehensive list of both services Medicare can cover without coinsurance or deductibles and services Medicare can cover with coinsurance or deductibles, there are stipulations for many of these services, that can affect whether they are covered or how they are covered. For more information, check the Medicare Preventive Services Handbook or contact us at (123) 456-7890 to schedule a consultation.

SOURCES:

Your Guide to Medicare Preventive Services, Centers for Medicare, and Medicaid Services Medicare Preventive Services: Coverage and Costs, National Council on Aging (NCOA) Medicare Rights Center

Sharon Galicia

Owner/Agent – Gulf South Benefits

I have worked with health insurance for 26 years, and have found it hard to watch people struggle through the process of signing up for Medicare. I want to make sure I can continue serving my clients turning 65 years old by making sure that they are getting the plan that is best for them, and that they can be confident in the decisions they make concerning their health.

ADDITIONAL RESOURCES

Medicare Information

We've put together easy-to-follow guides so you can better understand Medicare.

VIdeo library

Sharon Galicia discusses the ins and outs of Medicare.